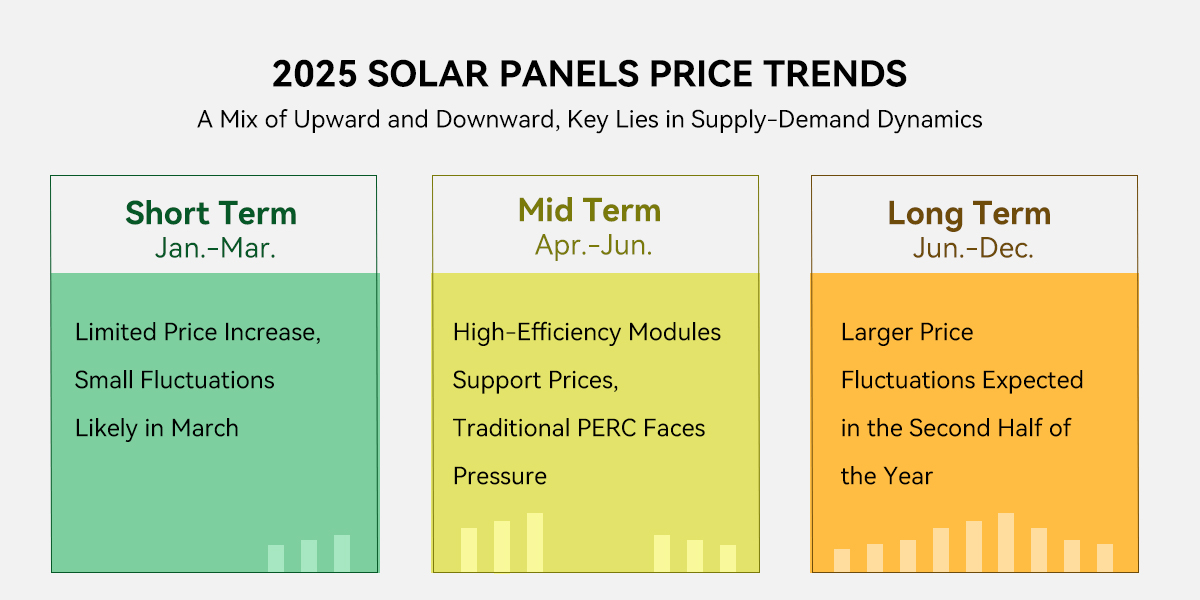

1. Price Trends: A Mix of Upward and Downward, Key Lies in Supply-Demand Dynamics

Short Term (1-3 Months):

Limited Price Increase, Small Fluctuations Likely in March

Supply Side:

Although the price of silicon materials and wafers has risen, the high inventory levels of module manufacturers have prevented price hikes from fully passing through to the end market.

Demand Side:

Due to the wait-and-see sentiment in 2024, the additional order demand from EPCs and distributors is limited, with small market growth.

Conclusion:

There is little chance of a large price increase in the short term, but inventory adjustments and short-term procurement fluctuations could lead to small price increases in March.

Mid Term (4-6 Months):

High-Efficiency Modules Support Prices, Traditional PERC Faces Pressure

High-Efficiency N-Type Modules (TOPCon/BC):

New capacity is being gradually released, and market demand remains strong, providing steady price support.

Traditional PERC Modules:

Due to increased market competition, traditional PERC modules could face price wars, with second- and third-tier brands likely to lower prices first to clear their inventories.

Conclusion:

The market will see a clear differentiation in prices. N-type modules are likely to remain stable, while PERC modules may face more pressure.

Long Term (6-12 Months):

Larger Price Fluctuations Expected in the Second Half of the Year

Export Market Challenges:

The US and EU may adjust trade policies (such as anti-dumping, CBAM, etc.), affecting export prices.

Domestic Demand Uncertainty:

The slowdown in the distributed market and issues with energy consumption could affect the domestic installation pace.

Conclusion:

Price uncertainty will increase in the long term, with policy risks and supply-demand mismatches becoming key influencing factors.

2. Optimizing Photovoltaic Trader Strategies: Flexibility in Response, Precise Market Positioning

Procurement Strategy: Lock in in Batches, Be Cautious with Stockpiling

In the current market environment, photovoltaic traders should avoid blindly stockpiling waiting for price increases, and instead adopt an order-driven procurement strategy, adjusting dynamically according to real demand and market signals.

For N-type high-efficiency modules, market demand is relatively stable, so it is advisable to lock in some stock. However, for PERC and other lower-end modules, stock management should be done carefully to avoid losses from price fluctuations.

Pay attention to the latest shipment prices and discounts from major brands (e.g., LONGi, Jinko, Trina, etc.) to ensure procurement plans are aligned with market trends.

Market Positioning: Precision Marketing, Avoid Low-Price Competition

As market competition intensifies in 2025, photovoltaic traders should avoid falling into the “low-price bidding” trap and instead focus on offering value-added services to stand out.

Focus on high-margin niche markets, such as:

✅ High-efficiency N-type modules (TOPCon/BC)

✅ Commercial & industrial rooftop projects (more stable profits compared to ground-mounted plants)

✅ Developing markets (Middle East, Latin America, Southeast Asia, etc.), where demand for high-efficiency products is growing rapidly.

Risk Control: Monitor Policy and Exchange Rate Fluctuations

Global policy changes in 2025 could increase market volatility, and photovoltaic traders need to prepare in advance.

✅ Pay close attention to European domestic production support policies, which could affect the export of Chinese modules.

✅ Exchange rate fluctuations (Euro, US Dollar) should not be overlooked, and hedging tools can be used to reduce exchange rate risks.

✅ Avoid over-reliance on a single market and maintain a diversified export strategy to mitigate policy risks from individual markets.

3. Conclusion: Adapt Flexibly, Stay Competitive

Short-term price fluctuations will be limited,

but small fluctuations in March are possible. Keep a close eye on market signals.

Mid-term market differentiation:

High-efficiency modules (TOPCon/BC) are likely to remain stable, while PERC and lower-end products may face price pressure.

Long-term uncertainty increases,

so it’s essential to monitor changes in overseas policies and domestic demand bottlenecks.

Photovoltaic traders should adopt flexible procurement and precise market positioning strategies,

avoiding blind stockpiling and price wars, ensuring they stand out in competition.

What’s the core strategy to avoid being "scalped" in the market?

✅ Don’t bet on one-way market trends, batch purchasing is key!

✅ Watch market signals and seize the profit points of high-efficiency N-type modules (don’t fight with PERC stock)

✅ Avoid low-price dumping price wars, focus on value-added business (such as European warehouse stock, customized projects)

Follow us now, and we’ll send you the latest photovoltaic market signals periodically to help you seize every potential opportunity!